The Group commits to responding to Taiwan’s net-zero carbon reduction laws and policies, while also referring to relevant international environmental and climate policies, to actively and pragmatically promote corporate climate management action plans.

To systematically assess the climate change risks and opportunities the Company faces, the Group, following the recommendations of the Task Force on Climate-Related Financial Disclosures (TCFD), promotes green low-carbon transition and climate adaptation strategies through the four core elements: governance, strategy, risk management, and metrics and targets. Subsequently, it will also follow the timetable set out in Taiwan Financial Supervisory Commission’s “Blueprint for Aligning with IFRS Sustainability Disclosure Standards” to disclose the quantified financial impact assessment results of climate-related risks and opportunities.

① Governance

✅Board of Directors’ Oversight of Climate-Related Risks and Opportunities

The primary responsible persons for climate governance in the Group are members of the Corporate Sustainable Development Committee and senior executives, whose main tasks are to set targets for the Company and review the achievement of these established targets; the Board of Directors is directly responsible for overseeing climate-related risks and opportunities.

The Corporate Sustainable Development Committee of the Group plans and oversees the development strategy for climate action. After analyzing the impact of climate change on operations, the Committee reports annually to the Board on strategy, annual budget, business targets, climate mitigation targets, and implementation status. The Corporate Sustainable Development Committee holds at least two meetings annually to report to the Board on planning and implementation progress, in order to evaluate and review ESG-related performance (including climate change management) of senior management in each department of the Company.

The Company intends to link the performance evaluation and reward system with the results related to climate change management, encouraging management to implement the corporate climate action development strategy in a way that ensures company profitability and sustainable operations, thereby creating value for shareholders and stakeholders.

✅Role of Management in Assessing and Managing Climate-Related Risks and Opportunities

The Chairperson of the Corporate Sustainable Development Committee delegates the “Sustainable Development Office” to plan and implement sustainability and climate change strategies, and is also responsible for identifying climate-related risks and opportunities, and formulating climate risk management policies. In the future, senior executives of the Sustainable Development Office will convene representatives of the Green Sustainability Project Task Force to conduct cross-departmental coordination and integration of management activities related to sustainability and climate change. Senior executives of the Sustainable Development Office will also regularly report implementation status to the Corporate Sustainable Development Committee.

The Green Sustainability Project Task Force is a cross-departmental working group that plans, implements, and integrates climate risk management, including introducing risk management mechanisms, establishing climate risk analysis methodologies, identifying climate-related risks and opportunities, conducting climate change scenario analysis, monitoring and evaluating compliance with climate change-related regulations, and undertaking work related to climate-related financial disclosures. In addition, the Green Sustainability Project Task Force will also be responsible for developing corporate energy-saving and carbon-reduction measures, promoting the use of renewable energy, and exploring other possible corporate climate change adaptation measures.

② Strategy

✅Identification of short-, medium-, and long-term climate-related risks and opportunities,and impacts on business, strategy, and financial planning

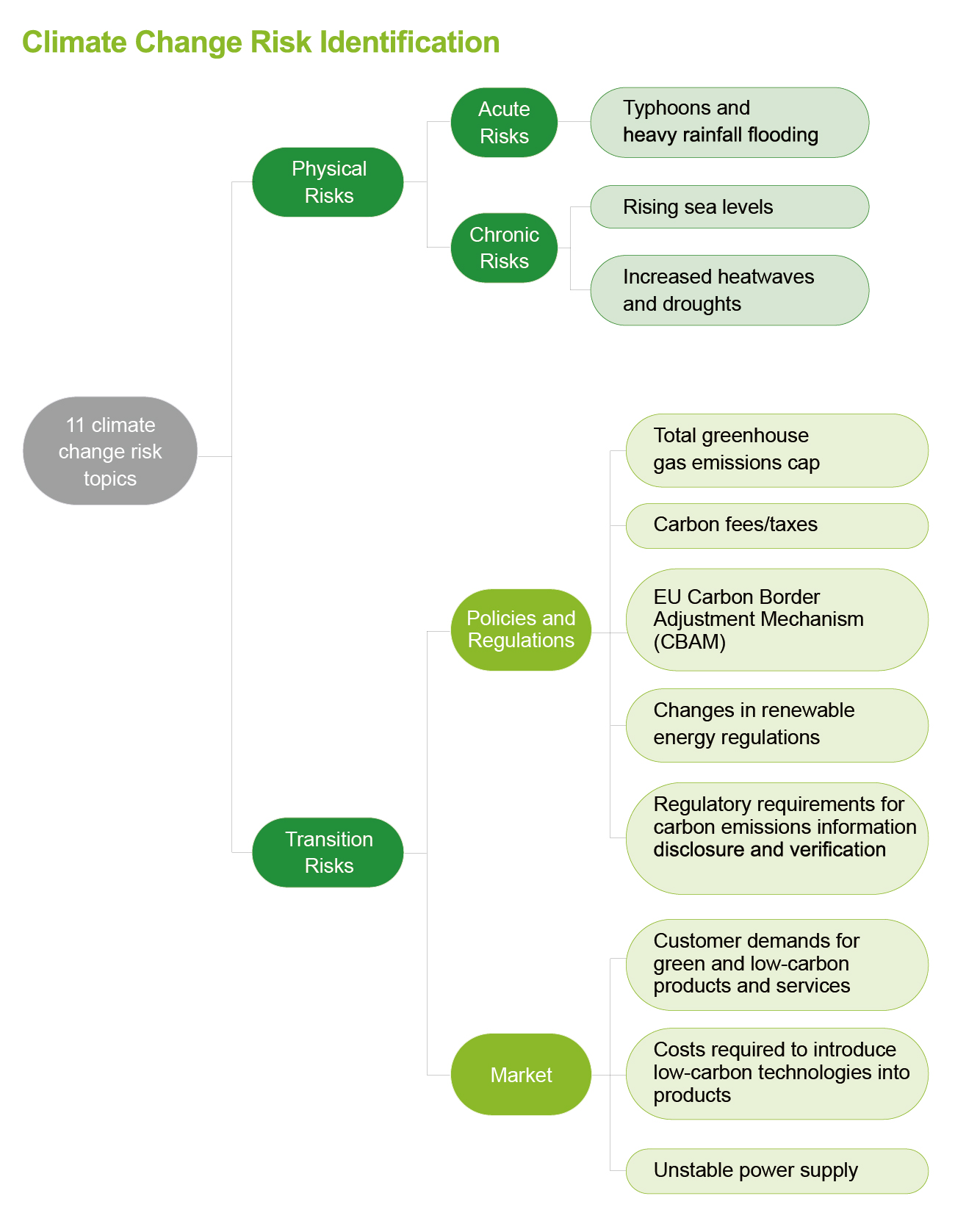

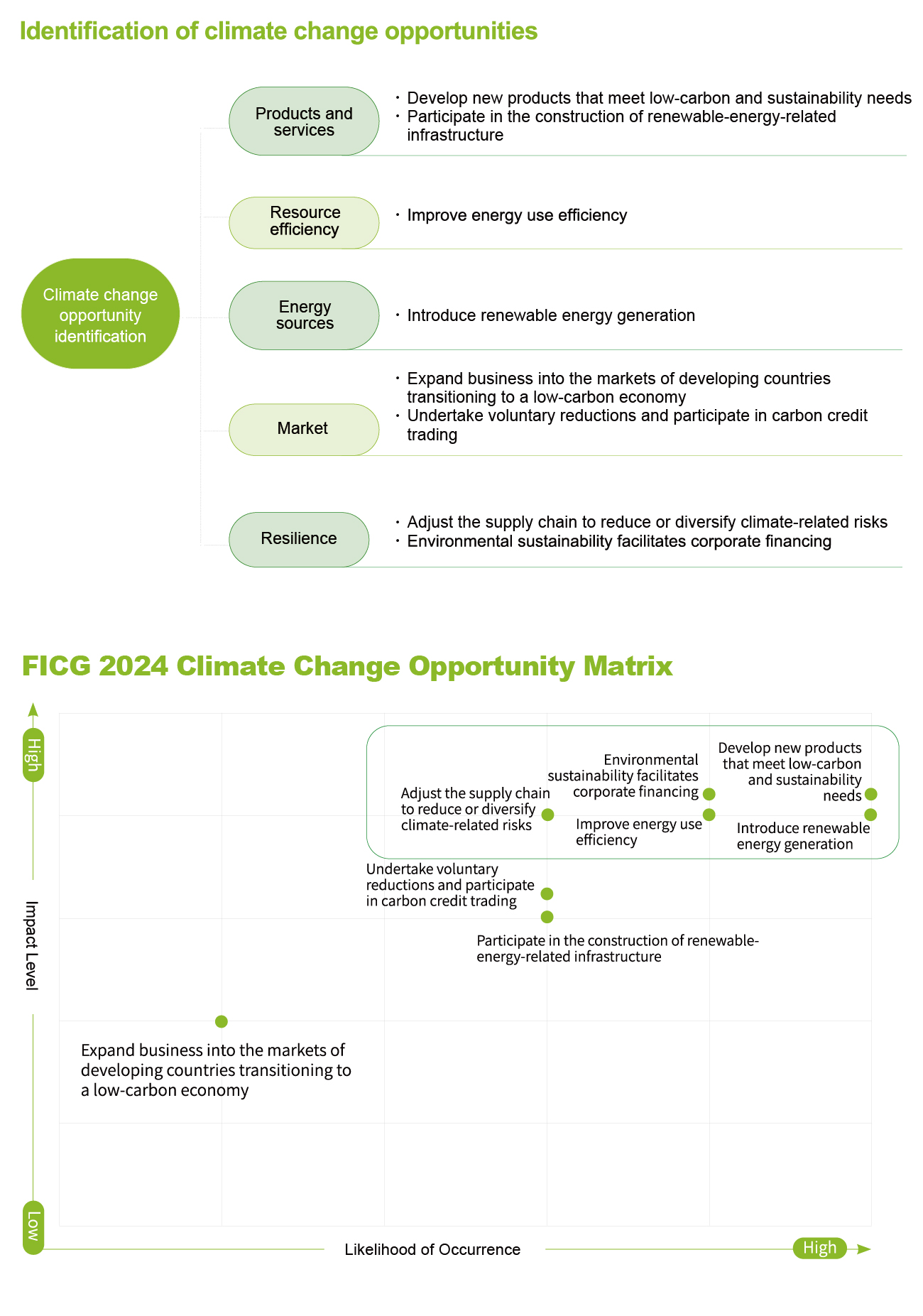

In accordance with the TCFD framework, conducts identification of climate-related risks and opportunities, the Group actively develops solutions, aims to reduce operational and financial impacts caused by climate change, and enhance the organization’s climate resilience. According to its climate change risk and opportunity assessment methodology, the Group defines short term as within the next 1 year, medium term as more than 1 year but within 5 years, and long term as more than 5 years but within 10 years, as the timeframe for assessing potential impact. The Group collects climate-related risk and opportunity topics for the domestic and international computer and peripheral equipment industry, consolidates the types of risks and opportunities, and then assesses the likelihood and level of impact of each risk and opportunity event on the Company, while considering the above short-, medium-, and long-term timeframes as the basis for potential impact assessment, to complete the Company’s materiality assessment and analysis of climate-related risks and opportunities. Through this process, it determines climate-related risks and opportunities that may have significant financial impacts on the Company.

Top five identified climate change risks

| Risk Categories | Risk Topics | Period of Occurrence and Topic Description | Financial Impact | Countermeasures |

| Acute Physical Risks | Typhoons and heavy rainfall flooding | Short Term (within 1 year) Typhoons, heavy rain, and other extreme weather events may affect plant operations, resulting in production stoppages, logistics delays, or equipment damage. If a company lacks comprehensive disaster prevention measures, in addition to property and revenue losses, it may also face higher insurance premiums and repair expenses. | Equipment damage and repair expenses Revenue loss caused by production line interruptions Increase in insurance costs and uncertainty in claims | ● Formulate typhoon, flood prevention, and water/electricity outage emergency plans and team assignments. ● Establish typhoon and flooding early warning response SOPs, including personnel evacuation, machine shutdown, and material transfer measures. ● Locate production lines or warehouses in multiple areas with lower geographic risk to disperse operational impacts caused by climate disasters. ● Regularly review disaster insurance coverage and claim conditions. ● In China plants, strengthen flood prevention facilities and flood resilience designs, including installing flood gates, drainage ditches, and pumping units, as well as raising the base height of key equipment. |

| Transition Risk – Policies and Regulations | EU Carbon Border Adjustment Mechanism (CBAM) | Medium-Term (1 to 5 Years) The European Union imposes carbon tariffs on imported products, which may increase the cost of exporting products to the EU and affect their price competitiveness. If corporate carbon emissions are not effectively managed and low-carbon transition is not implemented early, companies may face additional tariffs and market competitive disadvantages, thereby impacting revenue performance. | Increased costs: Supply chain cost pass-through: Decrease in price competitiveness: Increase in capital expenditure: Higher customs clearance and compliance costs: | ● Improve carbon inventory and data disclosure processes to ensure compliance with EU CBAM reporting requirements. ● Upgrade process equipment and technology to improve energy efficiency and reduce product carbon footprint. ● Enhance local procurement and strengthen supply chain cooperation to jointly reduce overall carbon emissions. ● Integrate corporate energy and carbon management systems to lower manufacturing carbon emissions and enhance data transparency. ● Establish a cross-departmental project task force to coordinate response strategies and monitor regulatory changes in real time. ● Adjust product pricing and market layout to address potential cost pressures from carbon tariffs. |

| Regulatory requirements for carbon emission disclosure and verification | Medium-Term (1 to 5 Years) As corporate sustainability information disclosure obligations become more stringent, the costs of carbon inventory and third-party verification have increased, requiring companies to allocate more resources to meet regulatory requirements. | Increased compliance costs: Risk of fines for disclosure errors or non-compliance: Impact of ESG ratings on investment valuation: Loss of customer orders: Internal carbon management expenditures: | ● Referencing ISO 14064-1:2018 and the requirements and recommendations of the Greenhouse Gas Protocol, regularly calculate organization-level greenhouse gas emissions. ● Implement energy management and carbon management systems to integrate emission data, equipment energy consumption, energy sources, and data for various emission categories. ● Engage third-party verification bodies to inspect emission data to ensure disclosures comply with regulations | |

| Transition Risk – Market | Customer demands for green and low-carbon products and services | In the medium term (over 1 year to within 5 years), companies and consumers are increasingly requiring suppliers to provide low-carbon products or sustainable solutions. If enterprises cannot meet market demand, they may lose competitive advantage, affecting revenue and brand value. | Rising R&D and design costs: Investments for equipment and process upgrades: Higher raw material procurement costs: Loss of orders or price pressure: Brand and market valuation risks: | ● Invest in green product R&D. ● Improve environmental performance of products and obtain relevant certifications. ● Increase the use of environmentally friendly packaging materials. ● In response to national policies and market demand, invest in the development of products such as energy management. ● Prime Technology’s on-site solar power generation for self-use effectively reduces carbon emissions and lowers operational risks. |

| Unstable power supply | Medium-Term (1 to 5 Years) In the process of promoting the transition to renewable energy, power shortages or unstable power grids may occur, and subsequent power rationing measures may lead to operational or production interruptions. If enterprises do not take preventive measures against electricity usage risks, they may need to install their own power generation or energy storage facilities, thereby increasing operating costs. | Loss from production line interruption: Investment in backup power facilities: Increased uncertainty in energy costs: Increased costs for power quality control: Risk of delay penalties and contract breaches: | ● Implement uninterruptible power supply (UPS) systems and backup generators to ensure stable operation of key equipment and server rooms. ● Establish emergency production plans after power outages, including load control alarms and emergency load reduction measures. ● Conduct power risk assessments for operating sites, giving priority to locations with stable power supply. ● Plan multi-site backup facilities to diversify risks in response to power outages in a single area. ● Establish communication channels with local power companies and competent authorities to obtain real-time power information and outage response notices. ● Incorporate green public welfare initiatives by investing in renewable energy development; formulate green power procurement methods and targets, and conduct regular tracking. ● Use intelligent energy management systems to effectively manage energy consumption. |

Top five identified climate change opportunities

| Opportunity type | Opportunity topic | Period of Occurrence and Topic Description | Financial Impact | Countermeasures |

| Resource use efficiency | Improve energy use efficiency | Short Term (within 1 year) Optimize production processes and equipment, and introduce intelligent energy-saving systems to improve energy and resource use efficiency; this not only reduces environmental impact but also lowers operating costs. | Reduction in operating costs: Reduction in cost volatility risk: Strengthening of corporate sustainability value: | Replace high energy-consuming equipment and introduce energy-saving equipment and intelligent control systems Establish energy management systems and carry out energy efficiency analysis and improvements Promote production line digitalization and smart manufacturing to optimize energy dispatch |

| Energy sources | Introduce renewable energy generation | Medium-Term (1 to 5 Years) Enterprises that invest in renewable energy generation equipment or procure green power on a long-term basis can reduce carbon emissions and enhance brand image, meeting global customer requirements. | Long-term optimization of electricity costs: Competitive advantage from emissions reduction: Avoidance of potential carbon costs: | Install solar power generation facilities for self-use at plants or sign green power -purchase agreements (PPAs) with renewable energy generators Purchase renewable energy certificates (RECs) Include the use of green power in the company’s sustainability performance indicators and disclose externally to enhance brand image and customer trust |

| Products and services | Develop new products that meet low-carbon and sustainability needs | Short Term (within 1 year) Developing low-carbon products that meet environmental needs will be favored by the market and attract corporate customers with higher ESG awareness, potentially bringing sales growth and increased revenue. | Open up new markets and increase revenue: Increase product gross margins and brand premium: Obtain R&D subsidies and tax incentives: | Establish a sustainable design department, introduce circular economy principles, and incorporate carbon footprint considerations into the product development process Focus on developing high-efficiency products and products using recycled materials Actively pursue green product label certifications and international eco-design standards |

| Market | Environmental sustainability facilitates corporate financing | Short Term (within 1 year) Global investment markets are becoming ESG-oriented; enterprises that implement green supply chain management, reduce carbon emissions, or adopt green power will find it easier to obtain green loans, sustainability bonds, or ESG fund investment, improving ease of financing and cost advantages. This also helps attract long-term investors, enhancing market competitiveness and corporate value. | Lower financing costs: Enhance investor trust and ESG rating performance: | Improve disclosure of carbon emissions and carbon management information and environmental performance indicators, compile sustainability reports, and obtain third-party verification |

| Resilience | Adjust the supply chain to reduce or diversify climate-related risks | Medium-Term (1 to 5 Years) Enterprises can diversify supply chain layouts to reduce risks from extreme climate disasters and geopolitics. By relocating parts of the supply chain to lower-risk regions in advance, they may ensure stable deliveries and enhance market competitiveness when supply chain crises occur. | Reduce risk of operational interruptions and loss costs: Enhance delivery stability and customer satisfaction: Create competitive advantages in green supply chains: | Map supply chain climate risk hotspots and diversify supplier sources to reduce risk Sign climate commitment agreements with suppliers to promote joint carbon disclosure and reduction actions Introduce supply chain environmental assessment tools as the basis for procurement decisions and business partner cooperation |

✅Resilience in strategy and consideration of different climate-related scenarios

Climate physical risk scenario: Typhoons and Flooding due to heavy rain

Taiwan Operating Locations

Taking into account that climate change may increase typhoons and extreme rainfall leading to flooding and operational disruption, the Group conducted scenario simulations using the Intergovernmental Panel on Climate Change (IPCC) Sixth Assessment Report (AR6) and data from the National Science and Technology Center for Disaster Reduction’s “Climate Change Disaster Risk Adaptation Platform.”

When considering greenhouse gas changes, the Group incorporated socioeconomic factors and referred to multiple Shared Socioeconomic Pathways (SSP) and Representative Concentration Pathways (RCP). Under four scenarios—SSP1-2.6 (low-emission scenario), SSP2-4.5 (medium-emission scenario), SSP3-7.0 (high-emission scenario), and SSP5-8.5 (very high-emission scenario)—different time scales were simulated to analyze flooding disaster risk at each operating site in Taiwan.

For key plants, flooding disaster risk simulations were conducted for different climate change scenarios in the short term (2021–2040), medium term (2041–2060), and long term (2081–2100). The risk components included three indicators: “hazard—weather and climate events,” “exposure—objects and degree potentially affected by external hazards,” and “vulnerability—the tendency of the system to be disaster-prone when facing hazards.” Based on risk levels from high to low, five grades were assigned: a flooding disaster risk level of 5 indicates the relatively highest disaster risk in the area, while a flooding risk level of 1 indicates relatively low disaster risk.

The results show that, in the Taiwan region, the headquarters office building of FICG and its subsidiaries (First International Computer, RuggON Corporation, Ubiqconn, Prime Base) located in Neihu District, Taipei City, falls under flooding risk level 3 (medium risk) in most emission scenarios and time periods; whereas the product manufacturing plants—Ubiqconn in Zhonghe District, New Taipei City, and Prime Base in Zhongli District, Taoyuan City—fall under flooding risk level 5 (very high risk) across all emission scenarios and time periods.

This risk is based on climate-change-related flooding disaster risk and uses administrative districts as the spatial unit of analysis. It effectively identifies high-risk locations, and such administrative delineation facilitates subsequent promotion and application. However, because administrative districts cover larger areas, although a preliminary determination can be made that they fall within a certain risk area, more precise management and planning still require actual conditions and more detailed analytical results.

| Operating Locations | Headquarters office building | |||||||||||

| Company Name | FICG / First International Computer / RuggON Corporation / Ubiqconn / Prime Base | |||||||||||

| Place Name | Neihu District, Taipei City | |||||||||||

| Emission Scenario | SSP1-2.6 Low-emission scenario | SSP2-4.5 Medium-emission scenario | SSP3-7.0 High-emission scenario | SSP5-8.5 Very high-emission scenario | ||||||||

| Period | Short term | Mid term | Long term | Short term | Mid term | Long term | Short term | Mid term | Long term | Short term | Mid term | Long term |

| Risk level (1–5) | 1 | 3 | 3 | 3 | 3 | 3 | 3 | 3 | 3 | 3 | 3 | 3 |

| Operating Locations | Product manufacturing plants | |||||||||||

| Company Name | Ubiqconn | |||||||||||

| Place Name | Zhonghe District, New Taipei City | |||||||||||

| Emission Scenario | SSP1-2.6 Low-emission scenario | SSP2-4.5 Medium-emission scenario | SSP3-7.0 High-emission scenario | SSP5-8.5 Very high-emission scenario | ||||||||

| Period | Short term | Mid term | Long term | Short term | Mid term | Long term | Short term | Mid term | Long term | Short term | Mid term | Long term |

| Risk level (1–5) | 5 | 5 | 5 | 5 | 5 | 5 | 5 | 5 | 5 | 5 | 5 | 5 |

| Operating Locations | Product manufacturing plants | |||||||||||

| Company Name | Prime Base | |||||||||||

| Place Name | Zhongli District, Taoyuan City | |||||||||||

| Emission Scenario | SSP1-2.6 Low-emission scenario | SSP2-4.5 Medium-emission scenario | SSP3-7.0 High-emission scenario | SSP5-8.5 Very high-emission scenario | ||||||||

| Period | Short term | Mid term | Long term | Short term | Mid term | Long term | Short term | Mid term | Long term | Short term | Mid term | Long term |

| Risk level (1–5) | 5 | 5 | 5 | 5 | 5 | 5 | 5 | 5 | 5 | 5 | 5 | 5 |

FICG and its subsidiaries will, based on the above flooding risk level analysis results, implement relevant climate change adaptation measures at each office building and plant, such as: strengthening flood prevention facilities and flood resilience design at plants; real-time monitoring of meteorological risks and preemptively allocating resources; formulating typhoon and flood early-warning and emergency-response SOPs; locating production lines or warehouses in multiple lower-risk areas to disperse operational impacts; and regularly reviewing disaster insurance coverage scope and claim conditions, striving to control the risk impact to the minimum possible extent.

China Operating Sites

FICG’s China subsidiaries “Prime Technology” (Guangzhou) and “Amertek Computer” (Shenzhen) are both located in Guangdong Province, in the Pearl River Delta of China’s southeastern coast, which is the largest provincial-level economy in China in terms of total economic output and population size.

In 2017, the Chinese Academy of Sciences released the research results of the China Comprehensive Climate Change Risk Zoning, which, based on climate scenario data for 2021–2050 under RCP 8.5 (the worst-case scenario with the highest emissions and most severe warming), analyzed the frequency and intensity of extreme climate events such as flooding, and classified hazard levels nationwide. The results showed that high flood hazard areas nationwide are mainly distributed along the eastern coast, the middle and lower reaches of the Yangtze River Plain, and the South China region — all of which include the Guangdong Province locations of FICG’s China subsidiaries.

In April 2024, southern China experienced a succession of extreme climate events such as hail and tornadoes, with Guangdong Province further suffering severe flooding caused by continuous heavy rainfall, resulting in significant economic losses. This event demonstrates that enterprises with operating sites in the area must promptly recognize the operational disruption and asset loss risks posed by the frequent occurrence of regional extreme climate events. In addition to actively adopting relevant climate change adaptation measures to control operational impact risks to the minimum possible extent, FICG’s China subsidiaries will also continue to monitor research, policy announcements, and countermeasures related to flooding and extreme climate events issued by local competent authorities and university research institutions, in order to enhance their own flood risk prevention and response actions.

Transition Risk Scenario Analysis

| Transition Risks | Climate Scenario | Scenario Assumption | Potential Financial Impact | Response Strategy |

| EU Carbon Border Adjustment Mechanism (CBAM) | SSP1-2.6 Low-emission | Full implementation of CBAM, covering computers and ICT products | Failure to disclose complete product carbon footprint will prevent exports to Europe; product cost competitiveness will decline | Improve carbon inventory and data disclosure processes to ensure compliance with EU CBAM reporting requirements; upgrade process equipment technology and improve energy efficiency to reduce product carbon footprint; integrate company energy and carbon management systems to reduce manufacturing-end carbon emissions and improve data transparency |

| SSP2-4.5 Medium-emission | CBAM gradually expands the types of products regulated | Need to cope with carbon taxes and inspection mechanisms, causing a decline in gross profit for some products | Adjust product pricing and market layout to cope with potential carbon tariff cost pressure | |

| SSP3-7.0 High-emission | CBAM only applied to high-carbon-emission industries, with inconsistent implementation standards | Although less restricted, market uncertainty is high, increasing investment and product layout risks | Prioritize carbon inventory for high-carbon-emission products; establish a low-carbon supply chain cooperation platform; procure low-carbon raw materials and strengthen supply chain cooperation to jointly reduce overall carbon emissions | |

| SSP5-8.5 Very high-emission | CBAM implementation progress stalls; divergence in carbon policies between Europe and the rest of the world | Short-term ability to export, but loss of long-term low-carbon transition incentives, resulting in brand image damage | Continue improving carbon emissions data collection and disclosure; establish a cross-department project team to coordinate response strategies and keep abreast of regulatory changes; undertake voluntary carbon reduction to maintain a good brand image | |

| Regulatory requirements for carbon emission disclosure and verification | SSP1-2.6 Low-emission | Most countries legislate mandatory carbon disclosure and verification, following international standards and requiring coverage of Scope 1, 2, and 3 emissions, with third-party verification required | Enterprises that fail to establish a complete carbon disclosure and verification mechanism will find it difficult to obtain bank financing, lose opportunities for cooperation with international brand customers, and may face heavy fines from government authorities for violating disclosure obligations, resulting in reputational damage | Integrate supply chain carbon emissions data to calculate Scope 3 emissions; use a carbon management platform to track and implement reduction plans for internal and supply chain carbon sources |

| SSP2-4.5 Medium-emission | Major economies gradually implement carbon disclosure regulations | Without early improvement of systems, enterprises will lag behind competitors and face both capital and brand pressure | Establish a carbon emissions inventory system; introduce energy management and carbon management systems to integrate emissions data; engage third-party verification agencies to verify emissions data to ensure disclosure complies with domestic and international regulations | |

| SSP3-7.0 High-emission | Regulations remain loose, carbon disclosure is voluntary, and only certain industries are subject to mandatory requirements | International capital, brand customers, and supply chains gradually exclude enterprises that do not disclose carbon information; enterprises failing to meet basic disclosure requirements are regarded as high-risk investments, leading to gradual loss of capital and orders | Continue monitoring domestic and international regulatory developments; improve the quality of carbon inventory and information disclosure | |

| SSP5-8.5 Very high-emission | Climate policy stagnates, no global consensus or standard for information disclosure is established, policies diverge among countries, and effective international cooperation is lacking | No short-term pressure, but unable to gain support from ESG-focused investors; long-term capital costs will still increase | Maintain carbon inventory and information disclosure mechanisms to preserve investor trust and reduce the risk of future market exclusion | |

| Customer demands for green and low-carbon products and services | SSP1-2.6 Low-emission | Customers fully require suppliers to establish and implement carbon reduction targets (such as SBTi). | Products that do not meet standards will be unable to enter the supply chains of international brands. | Fully invest in green product R&D, increase the use of environmentally friendly green packaging materials, enhance product environmental performance, and obtain relevant certifications. |

| SSP2-4.5 Medium-emission | Customers gradually require carbon disclosure and environmental certifications, but such requirements have not yet extended to all product types. | Products must gradually transition to low-carbon, otherwise large project orders will be lost. | In response to national policies and market demand, invest in the R&D of products such as energy management, provide low-carbon and energy-saving products and services, and capture future green business opportunities. | |

| SSP3-7.0 High-emission | Only some European and American brand customers have demands for green products. | The pressure for green products is not yet comprehensive; however, early response can secure differentiated competitive advantages. | Introduce small-scale green certification pilots and communicate future development plans with target customers. | |

| SSP5-8.5 Very high-emission | Customers focus only on product price and cost, neglecting green product requirements. | Short-term incentives for green transition decline, making it difficult to establish sustainable brand value. | Continue developing low-carbon technologies to prepare for shifts in market trends. | |

| Unstable power supply | SSP1-2.6 Low-emission | Green electricity supply is sufficient and prices are gradually stabilizing. | Those not using green electricity will be excluded from net-zero supply chains and lose most customers concerned with ESG. | Continue integrating green public welfare initiatives and invest in renewable energy development; formulate green electricity procurement methods and targets and conduct regular tracking. |

| SSP2-4.5 Medium-emission | Green electricity prices are volatile, and acquisition conditions vary by region. | The cost pressure of green electricity increases, affecting operating costs and the progress of carbon reduction targets. | Prioritize site selection in areas with stable power supply or industrial parks with backup resources; plan multi-site backup facilities to disperse the risk of power interruption in a single area. | |

| SSP3-7.0 High-emission | The pace of renewable energy deployment is slow, and supply is unstable. | Power outages or electricity rationing affect production schedules and delivery performance, resulting in customer loss. | Establish communication channels with local power companies and competent authorities to obtain real-time power information and blackout response notices; use intelligent energy management systems to effectively manage energy use. | |

| SSP5-8.5 Very high-emission | Extreme weather causes power outages, with severe damage to energy infrastructure. | Production lines face shutdown risks, and order fulfillment capacity declines. | Introduce uninterruptible power supply (UPS) systems and backup generators to ensure stable operation of critical equipment and server rooms. |

③ Risk management

✅ Identification, Assessment, and Management of Climate-Related Risks

Each department of FICG and its subsidiaries responds to risk events in a timely manner through the risk management process, in order to reduce or avoid the impact of such events and ensure sustainable operations. Through processes such as risk identification, risk measurement, risk monitoring, risk reporting, and risk response, climate-related risks and opportunities are identified, strategies are formulated, and action plans are proposed, with regular reports submitted to the Board of Directors.

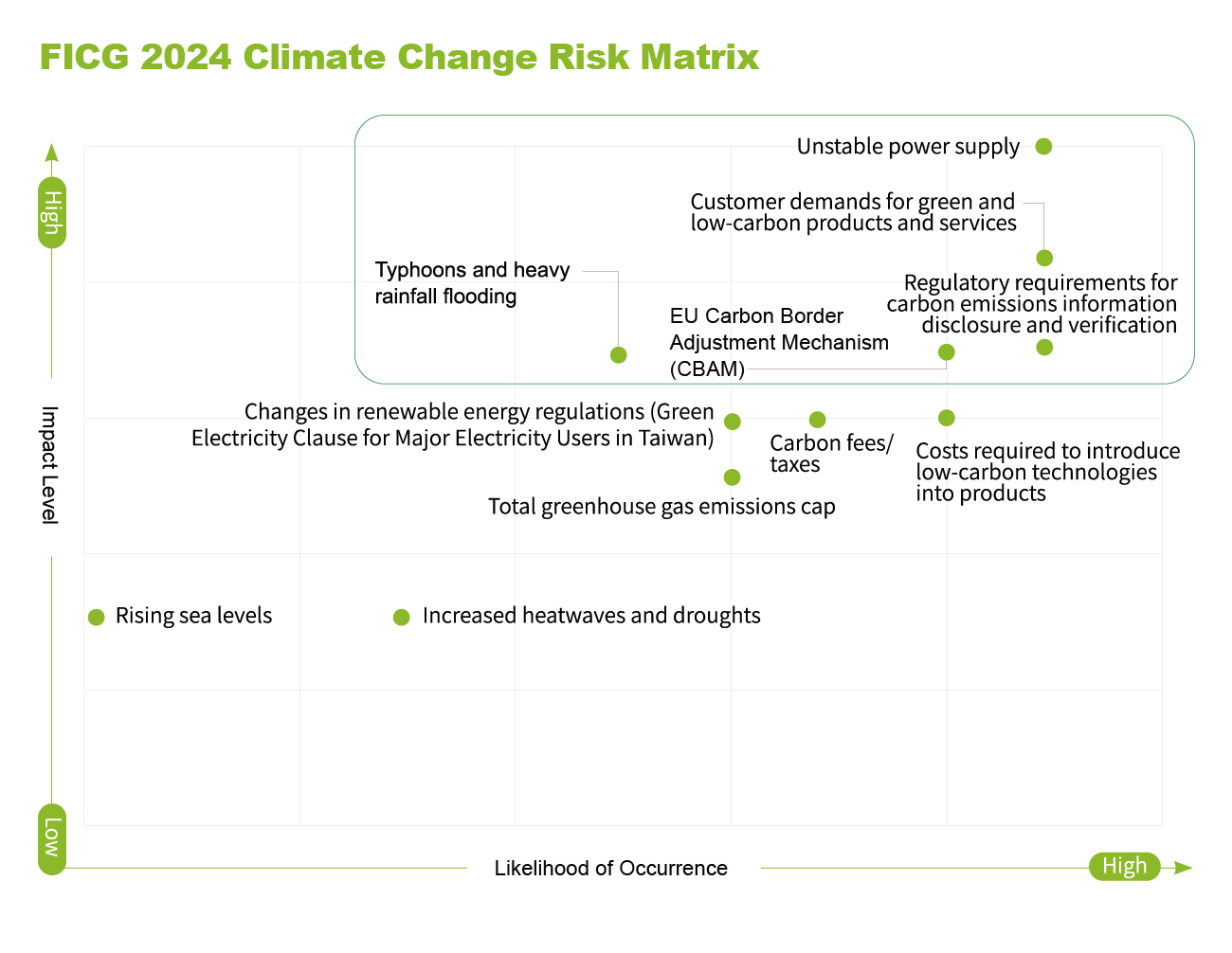

FICG conducts a comprehensive review of its operations (including internal operations and external interactions), analyzes climate change risks and opportunities, and ultimately identifies 11 risk issues and 8 opportunity issues that are more closely related to the Company’s business activities. A “Risk Management and Climate-Related Opportunity Survey Questionnaire” was designed for these risks and opportunities and distributed to 49 managers at the associate general manager level or above within the Company, with all questionnaires completed and returned. This was used to assess the likelihood of occurrence and the degree of impact of climate-related risks and opportunities on the Company, while also considering the timeframe in which such risks may have an impact, the completeness of existing relevant control measures, past experience, and peer cases, thereby completing the Company’s materiality assessment and analysis of climate-related risks and opportunities.

Based on the above analysis results, the top five climate risk issues (typhoon and heavy rain flooding, EU CBAM, regulatory requirements for carbon emissions information disclosure and verification, customer demand for green and low-carbon products and services, and unstable power supply) and the top five climate opportunity issues (improving energy efficiency, introducing renewable energy generation, developing new products that meet low-carbon and sustainability demands, environmental sustainability facilitating corporate financing, and adjusting the supply chain to reduce or diversify climate-related risks) were identified, and a climate change risk matrix and opportunity matrix were prepared accordingly.

In the future, FICG plans for the Green Sustainability Project Task Force to conduct short-, medium-, and long-term impact assessments and management of climate-related risks, and to propose improvement plans for high-risk items to maintain a comprehensive risk management system. The Company also plans to integrate the climate-related risk management process into its overall internal control system and risk management process, with the responsible units regularly reporting operational results to the Corporate Sustainable Development Committee and the Board of Directors; it will also work on improving the internal audit mechanism to periodically review the design of the internal control system for climate-related risks, as well as the effectiveness of its implementation and findings from audits.

④ Indicators and Targets

✅ Climate Change Risk Management Indicators

Medium- to Long-Term Carbon Reduction Target

- With reference to the government’s “2050 Net Zero Emissions Roadmap,” the Group has set a long-term goal of achieving net zero greenhouse gas emissions by 2050.

- Starting in 2025, the Group will gradually implement relevant operations in accordance with IFRS Sustainability Disclosure Standards (IFRS S1 and S2), with plans to complete the integration and disclosure of climate risk management cost analysis by 2029.

- The near-term carbon reduction pathway and medium-term targets are currently being planned, and starting in 2025 will be gradually incorporated into annual action plans and key performance indicators to manage climate risk transition plans.

- The Group will assess the carbon reduction potential of each operating site, giving priority to the use of renewable energy and the implementation of carbon reduction plans; where adoption is not possible, it will consider carbon offsets or the purchase of renewable energy certificates (RECs) to achieve the target.